As I had said in my first post, we will be using Index Funds and rank them based on their performance (Momentum), to build ourselves a portfolio.

To get into mutual funds we first need to understand what they actually are, how to invest in them and what the costs involved are.

What are Mutual Funds :

A mutual fund is essentially a vehicle to invest in the markets. Say for example you realise that India is transitioning to a middle class economy and its citizens are starting to buy more and more cars and bikes. Demand for vehicles is booming, Automotive companies are making hay while the sun shines and you want to get in on the ride.

You decide that you want to put a little money in every major Automotive company, all the large established manufacturers of cars, bikes and parts. Now one option is to go and buy shares / equity in each of these large companies. Unfortunately you know the sector is doing well but don’t have either the time, the resources or even the knowledge to narrow down on which companies exactly are doing well. There are more than 50+ Auto and Auto-Ancillary companies in India, and we would have to delve into each and every one of them to decide which ones are worth buying into.

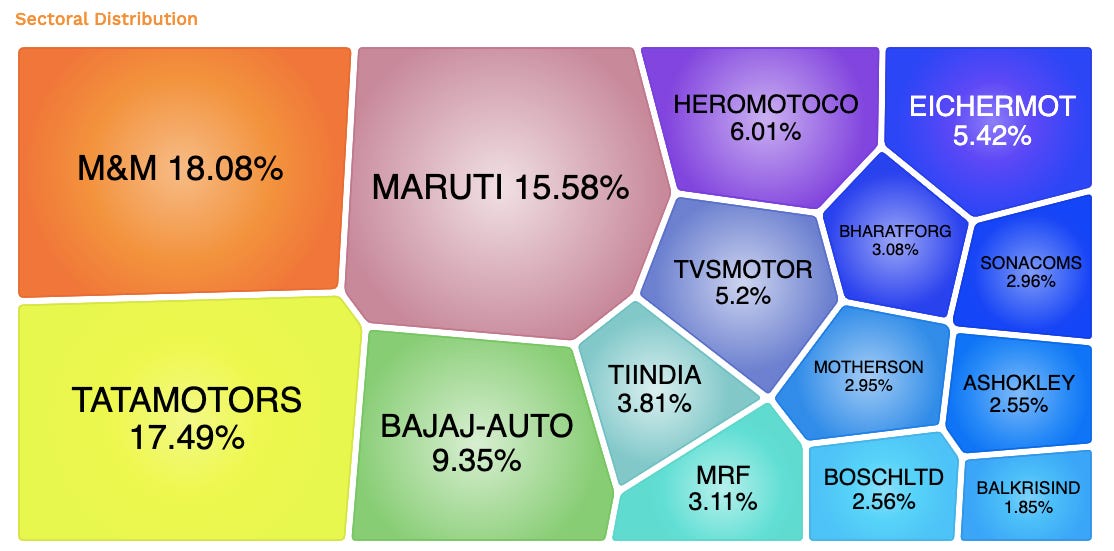

The alternative is to simply buy into an Index Fund, NSE (National Stock Exchange) has a list of Indices, amongst these there is an Auto Index which comprises the largest Automotive co’s in the country, the NSE Auto Index is a ready made Index of the largest Auto co’s in the country ranked by Free Float Market Capitalisation*.

*Free Float Market Capitalisation - A public company has two types of shareholders, one the promoter or the fellow actually running the company & two everybody else. Now the shares owned by the promoter are not bought and sold i.e. they are locked in with him, so the shares available to be traded are what’s owned by everyone other than the promoter. The value of these “free / unencumbered” shares is what makes up the free float.

Total Shares : 100

Price of Each share : Rs. 10

Total Market Capitalisation = 100*10 = Rs.1000

Shares owned by the Promoter = 60

Free Shares : 100-60 = 40

Free Float Market Cap = 40*10 = Rs. 400

Here’s where the Mutual Fund finally comes into play, a mutual fund will invest into these stocks in the exact weights as given by NSE (who makes and maintains the Index). Instead of directly purchasing these stocks you would instead purchase a mutual fund which purchases them on your behalf.

The AMC’s :

Now NSE makes the index but the company who launches a fund which replicates the Index is called an AMC (Asset Management Company), in short an AMC is the company that manages every single thing about a fund. It hires fund mangers, analysts, takes care of paperwork & makes sure it operates within the rules laid down by SEBI.

The Fund :

Going back to our Nifty Auto example currently there is one AMC offering an Index Fund which tracks the Nifty Auto Index. ICICI Prudential “ICICI Auto Index Fund”.

Now there are some important features each Mutual Fund has ;

Expense : The expense for this fund is 0.39%. This means if you invest Rs. 100,000, the AMC will charge you 390 rupees to manage your money.

NAV : The NAV (Net Asset Value) is essentially the price of one unit of the fund. The current NAV is 16.8405, so for an investment of Rs. 100,000 you will get 5938.06 units (100,000/16.8405).

Units : Think of these as shares, you will own ~5938 shares of ICICI Pru’s Nifty Auto Index. Each unit will consist of the underlying shares which comprise the Nifty Auto Index in the same weightage as published by NSE, shown in the image above.

Minimum Investment : Each fund has a certain requirement for a minimum investment, for this particular fund the minimum is Rs. 1,000. Now this is one the major advantages of mutual funds, you can start small. If we tried to purchase these stocks individually we would end up having to invest a lot more just to get a single share, for example one share of Maruti is currently Rs. 11,510/sh. Mutual Funds reduce the entry barriers and they allow us to start small, setting out to buy these stocks directly is not a problem if you know what you are doing and have the money to invest but for the average Joe starting out with 1,000 is more achievable.

Buying a Mutual Fund : Each AMC has a website. A few basic details to set up an account will be required, your PAN number and Bank details. You can and should sign up directly with the AMC’s and buy it from them directly its an easy and transparent process. For example explore iPru’s website and see the steps required to sign up :

iPru AMC

Folio Numbers : A folio number is a unique number almost like a bank account which will contain all your mutual fund holdings for the same AMC. So even if you buy multiple mutual funds from ICICI Prudential they all will be linked to one single folio number. This makes it easier to track your holdings.

Types of Plans : There are a few types of plans, the same Auto Index fund can be purchased as a Regular or Direct plan. Without getting into the fine print just buy direct plans, this essentially means you are purchasing it directly from the AMC and cutting out any unnecessary middle-men. Direct plans have two subsets :

Dividend Payout : The underlying shares will pay dividends which are then transferred to your bank account, you will receive the dividend as cash.

IDCW : Here the dividend received is not paid to you, instead you will get more units of the same fund. For example you may receive a dividend of Rs. 1000 on your original Rs. 100,000 investment, instead of paying you the 1,000 you will get units worth a 1,000 rupees (1,000/16.805 NAV). Instead of the money you will get surplus units.

If you don’t need regular income into your account, its preferable to reinvest dividends so the Direct - IDCW is usually the best way to go.

Exit Load : Some funds also have an exit load, its sort of a penalty you pay for exiting / selling your units. For example if you sell your units within 1 year of purchase you will have to pay a 1% penalty i.e. 1% of your portfolio value. Normally selling units post after the completion of a year won’t have an exit load.

Benchmark : Every mutual fund scheme has a benchmark now naturally for an Index Fund like we discussed above the Benchmark is the Index. So for the ICICI Prudential Auto Index Fund, the Benchmark is the Nifty Auto TRI (Total Returns Index). TRI includes all the dividends the underlying shares paid out.

Well that’s about all i’m going to bore y’all with for this week, as always let me know if this was easy to understand and if its helped better your understanding. Next week we will be building our portfolio using these very index funds.

Cheers,

Hriday.

Disclaimer : The content of this article is not investment advice and does not constitute any offer or solicitation or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. Investment involves risk.

Such an informative post! Got to save it!